How to trade VIX options

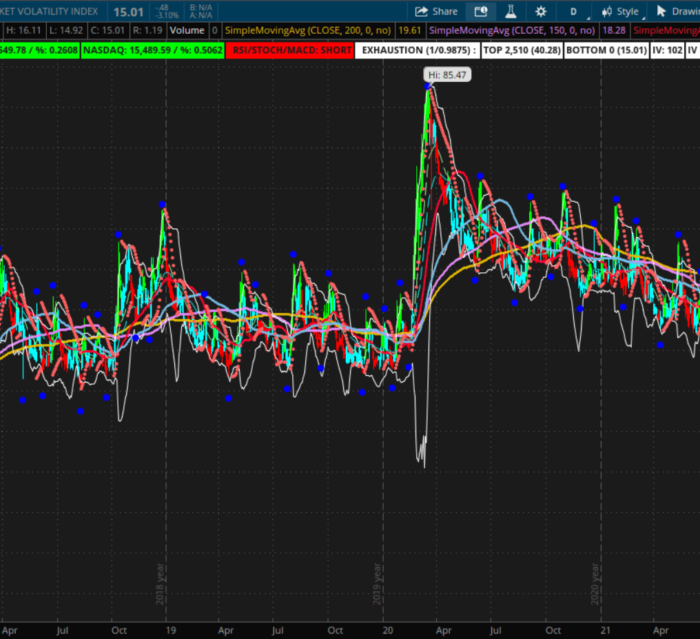

The Volatility Index, commonly called the “VIX,” is a widely recognised index that measures the market’s expectation of 30-day forward-looking volatility. This index is a valuable tool for options traders, providing insights into market sentiment and potential price fluctuations.

VIX options, derived from the Volatility Index, can be a powerful instrument in the arsenal of a knowledgeable trader. These options offer opportunities to hedge against market downturns or speculate on future volatility, providing flexibility and potential gains in various market conditions.

While trading VIX options may initially appear daunting for UK investors, it is essential to note that with careful strategy and understanding, it can be both feasible and potentially lucrative. By staying informed, utilising risk management techniques, and capitalising on market trends, investors can navigate the intricacies of VIX options trading and potentially benefit from this dynamic investment instrument.

Understanding VIX options

VIX options are unique, primarily because they do not trade on standard equity but on the expected future fluctuation and volatility of the S&P 500 Index. It means that VIX options behave differently from regular stock options, affected by factors such as “the fear gauge.” VIX options are European-style options, meaning they can only be exercised at expiration, and their underlying asset is the VIX calculation itself, which cannot be purchased directly. VIX options trade on futures contracts, such as the VIX futures traded on the CBOE Futures Exchange (CFE).

Requirements for trading VIX options in the UK

To trade VIX options in the UK, you must have a brokerage account with an authorised broker that offers access to US options because VIX options are currently only listed on US exchanges and cannot be traded directly through UK brokers. Additionally, you may also need to meet specific eligibility requirements set by the CBOE and your chosen broker, such as the required level of trading experience and capital.

Factors to consider before trading VIX options

Before diving into trading VIX options, there are several crucial factors for UK investors to consider:

Volatility

As the name suggests, VIX options are susceptible to volatility-level changes. Volatility, which refers to the degree of price fluctuations in the UK market, can have a significant impact on the value of VIX options. Therefore, it is crucial to thoroughly understand and analyse market volatility trends before considering VIX options trading. By closely monitoring and evaluating the volatility patterns, traders can make informed decisions and potentially capitalise on the opportunities that arise from fluctuating market conditions.

Expiration dates

VIX options have monthly expiration dates, typically on the Wednesday 30 days before the third Friday of each month. However, there are also weekly VIX options with a shorter period. It is essential to know these expiration dates and their corresponding implications when trading VIX options. For example, as European-style options, VIX options cannot be exercised before expiration, meaning traders must accurately time their positions to maximise profits.

Liquidity

Liquidity measures how easy it is to purchase or sell a share or security without significantly affecting its price. Regarding VIX options, liquidity is essential because it can impact the bid-ask spread. More inferior liquidity could mean a wider bid-ask spread, making it more expensive for traders to enter and exit positions.

Strategies for trading VIX options

Trading VIX options involves complex strategies that are beyond the scope of this article. However, here are some common strategies used by UK investors when changing VIX options:

Hedging

Using VIX (Volatility Index) options as a hedge can be a valuable trading strategy to protect against adverse market movements. For example, suppose a trader has an investment portfolio heavily weighted towards stocks. In that case, they may choose to buy VIX put options, which gives them the right to sell VIX contracts at a predetermined price, thus offsetting potential losses in case of a market downturn.

This strategy, commonly known as “portfolio insurance,” enables investors to mitigate risk and safeguard their investments in volatile market conditions. By incorporating VIX options into their risk management strategy, investors can enhance their overall portfolio resilience and improve long-term returns.

Speculation

Traders can also use VIX options as a speculation tool, taking advantage of expected market volatility to make profits. For instance, if investors anticipate a significant market event or news that could cause volatility spikes, they may opt for extended VIX call options to profit from the price movements.

However, it is essential to note that speculating on VIX options carries a higher risk than hedging. It requires thorough analysis and market knowledge, as well as the ability to predict future volatility levels accurately.

The bottom line

Trading VIX options in the UK may seem challenging at first. Still, with a solid understanding of VIX options and market factors, it can be a viable option for investors in the UK looking to diversify their portfolio or capitalise on market fluctuations. As with any investment, it is crucial to conduct sound research and consult with a financial advisor before making any trading decisions. With careful planning and proper risk management, VIX options can be a powerful tool for UK investors to navigate the constantly changing market landscape.